Quarterly Decision Coverage.

Every quarter: updated horizon, new briefs as decisions emerge, and a review session with leadership. Your software decisions — continuously prepared.

Clarity doesn’t last by itself

Most teams don’t lose control of their stack overnight. It happens slowly — as tools change, owners move on, and renewal cycles come back around.

Context gets lost. Decisions get repeated. Leverage disappears.

Tools keep appearing. Nobody removes the old ones.Drift

Savings disappear quietly.Erosion

The market moved. Your assumptions didn't.Blindness

What Coverage delivers

Not a dashboard to check. A rhythm that keeps you prepared — delivered, not self-serve.

- Quarterly reviews — 60-90 min with leadership. What changed. What's forming. What needs attention.

- Rolling briefs — 4-6 executive briefs per year, as decisions emerge. Same Five Lenses analysis.

- Updated decision horizon — 12-18 month view, continuously current.

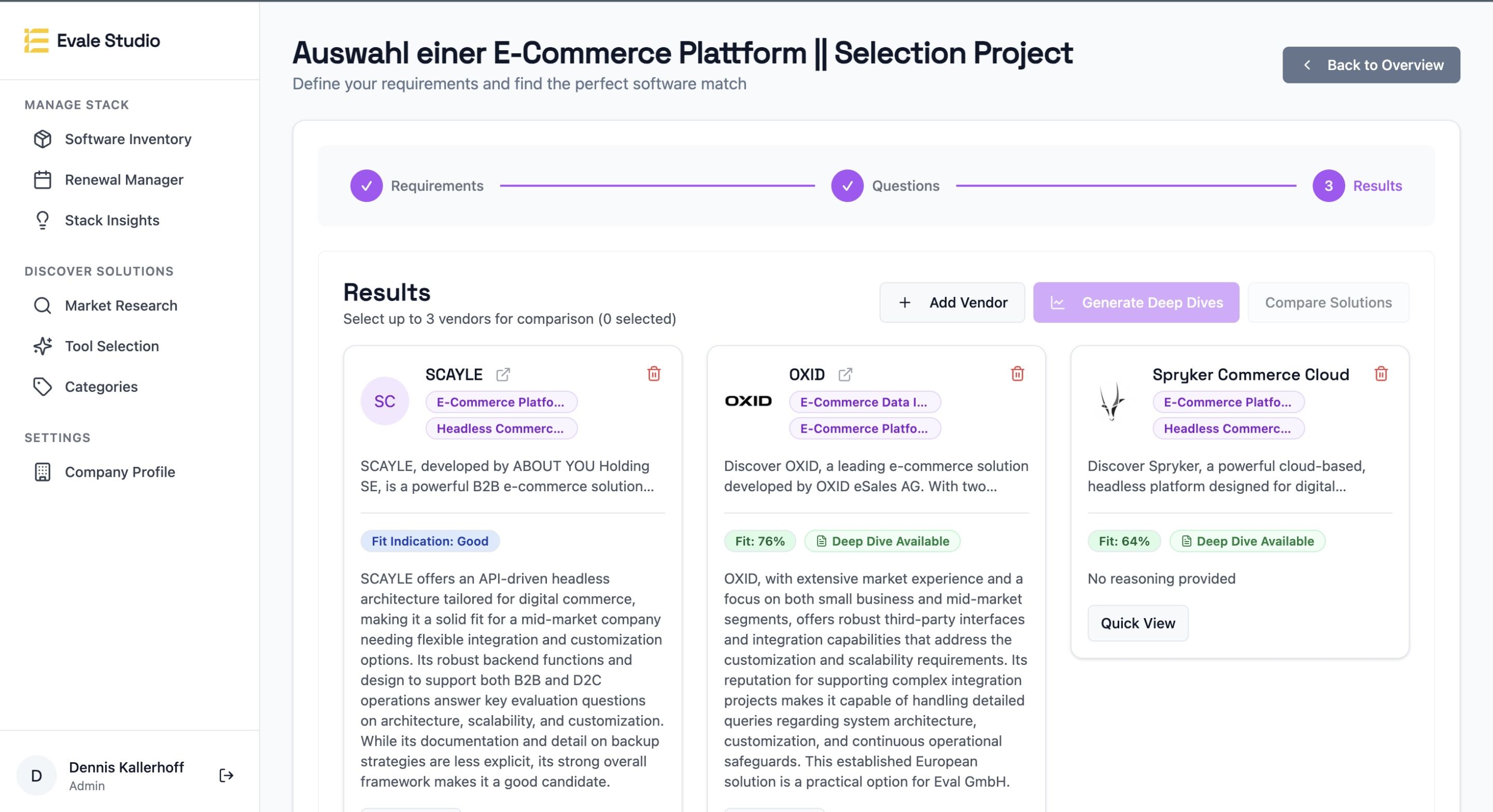

- Software access — Your inventory, decisions, and briefs in one place.

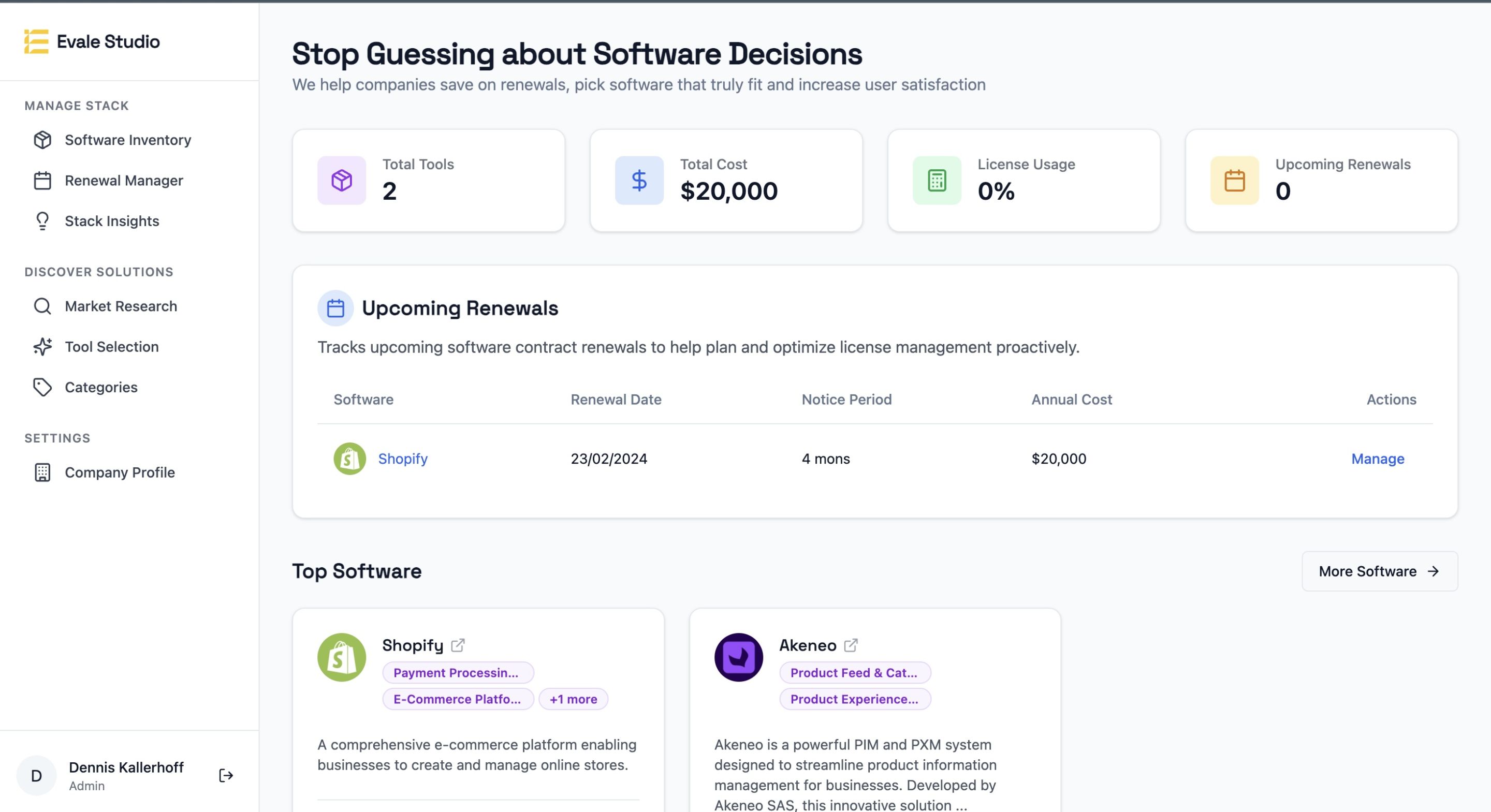

What's in the software

Your workbench for decision readiness. Not a feature-heavy platform — a place where context lives.

Inventory + market data

Your software, contracts, renewals — connected to intelligence on 12,000+ vendors. Not a static spreadsheet. A live system enriched with market data.

- Pricing patterns, renewal behavior, switching profiles — built in

- What similar companies pay — so you know where you stand

- Vendor signals tracked — acquisition risk, roadmap shifts, pricing changes

- Continuously updated — you don't track vendor pricing pages

Upcoming decisions

What's forming over the next 12-18 months. Basic decision data: timing, risk, context. So you're not surprised when renewals arrive.

- Renewals with leverage windows — when to engage, when it's too late

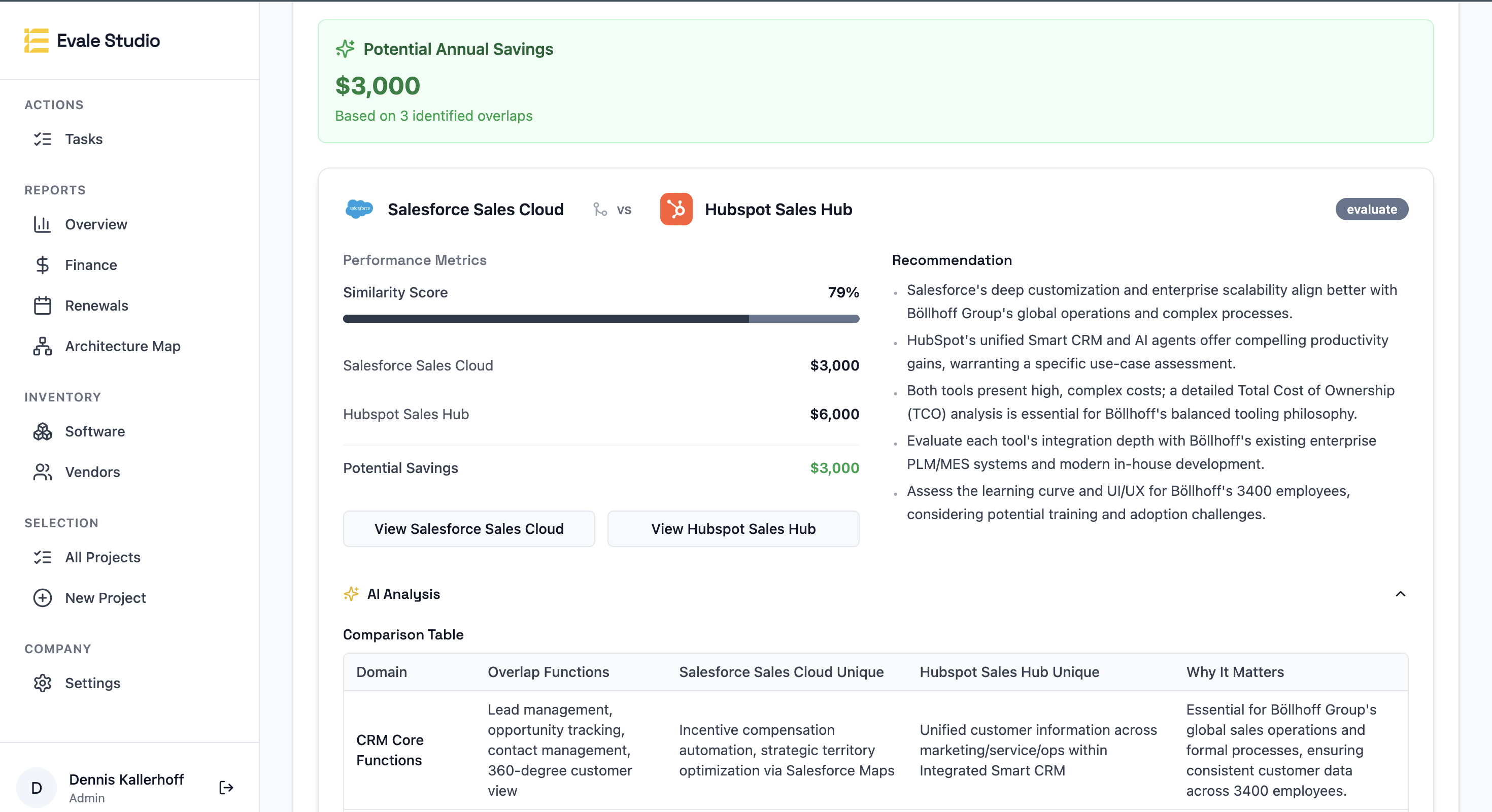

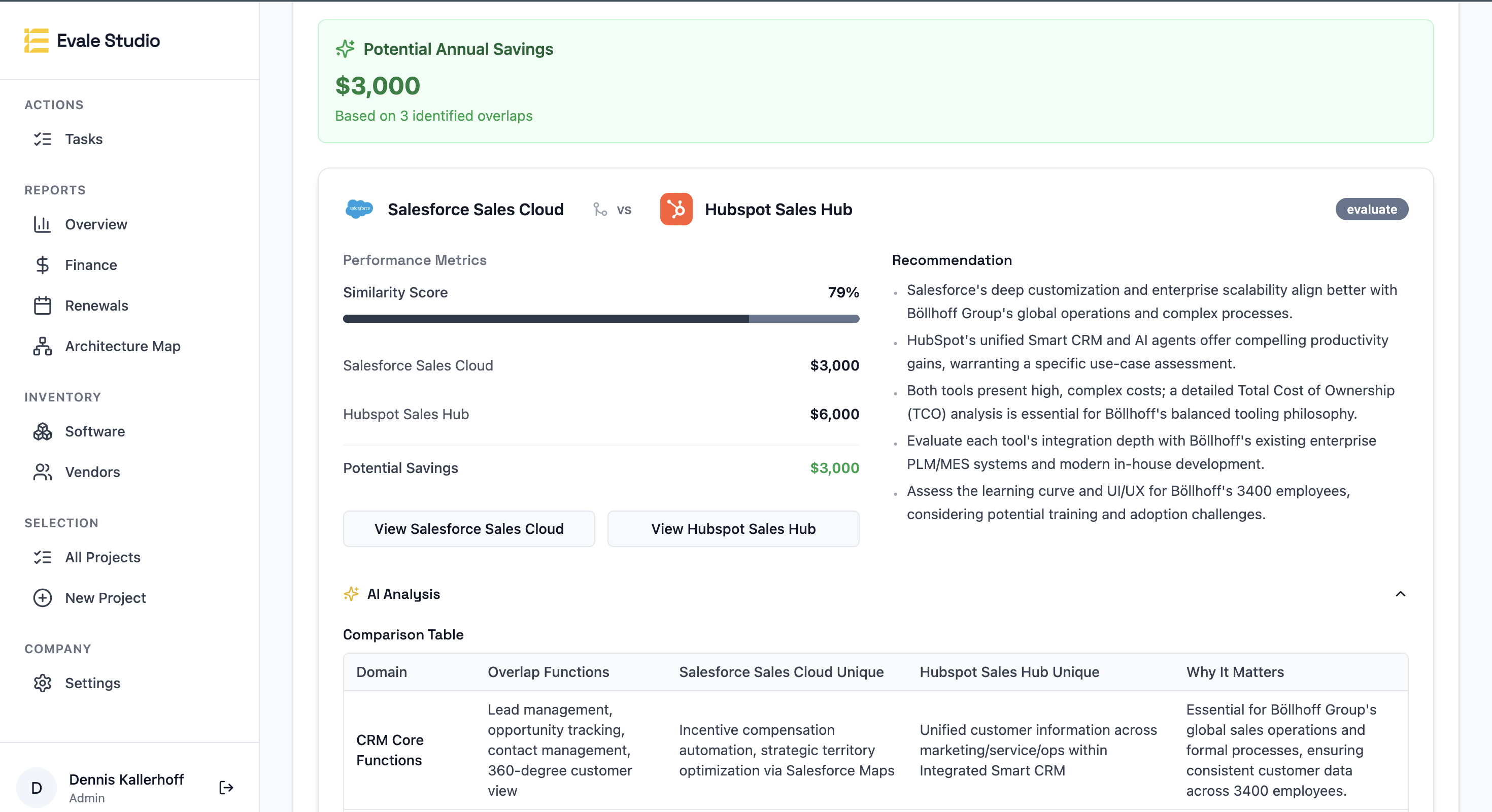

- Overlaps and consolidation opportunities — forming before they calcify

- Risk signals — before they become urgent

- Past decisions and their rationale — so context doesn't leave with people

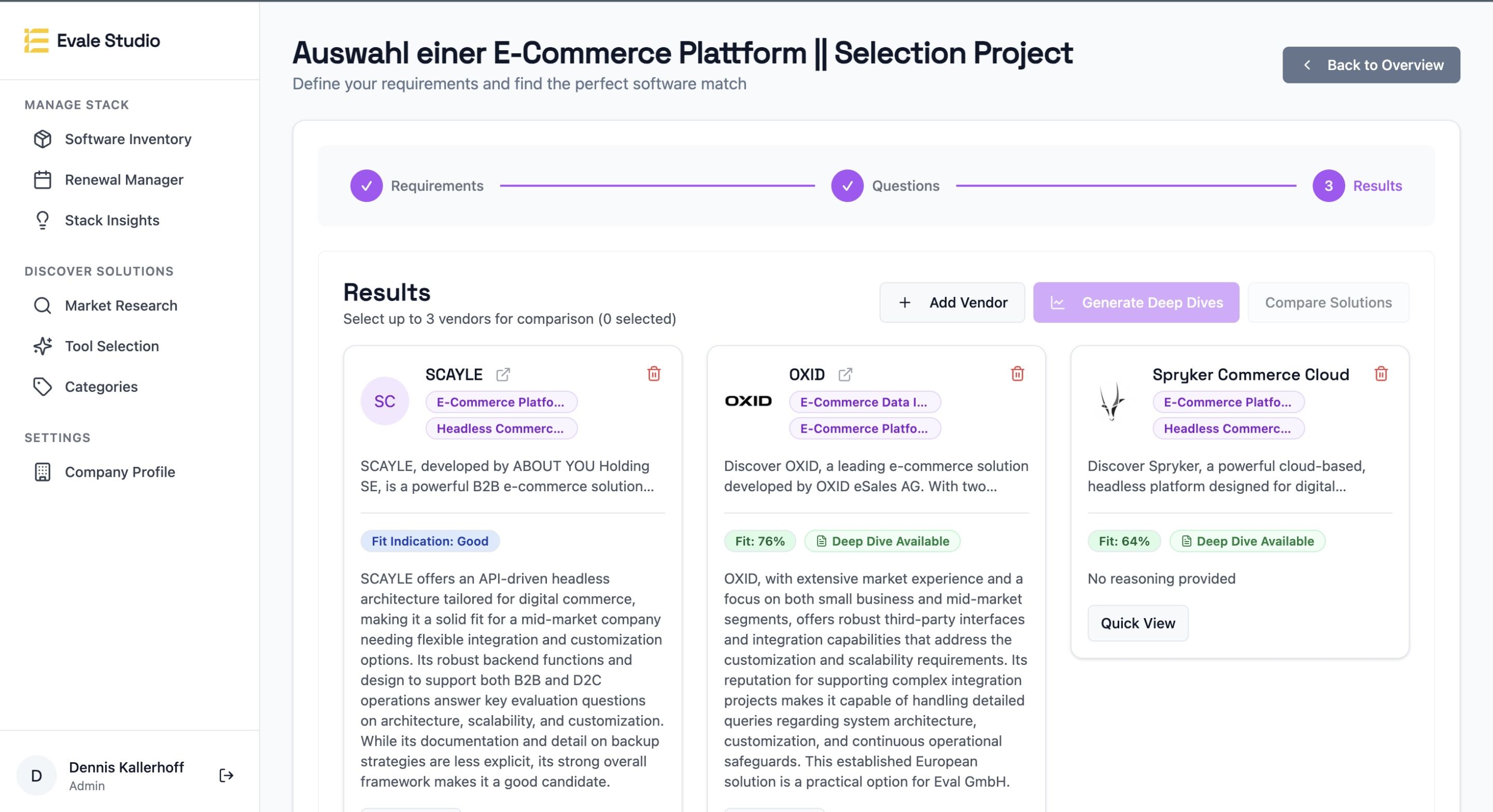

Artifacts for important decisions

Executive briefs with Five Lenses analysis. Recommendations, negotiation levers, rationale preserved — so context doesn't leave with people.

- Briefs linked to decisions — everything in one place

- Past decisions searchable — by tool, date, or decision type

- Queryable via API and MCP — connect to your existing tools

- Ask questions in plain language — "What's risky in Q1?" "Why did we keep Tool X?"

Where it all lives

Not a feature-heavy platform. A workbench that keeps your decisions current. When the CFO asks a question, the answer is there.

- Your inventory — connected to market data on 12,000+ vendors

- Upcoming decisions — what's forming, when leverage opens and closes

- Your briefs — Five Lenses analysis, recommendations, negotiation levers

- Everything queryable — via API and MCP, in plain language

Your context + market intelligence

The briefs aren't opinion. They're your situation analyzed against the market. Your constraints and priorities combined with intelligence on 12,000+ vendors. This is what makes briefs specific to your company — not generic advice.

12,000+

Continuous

Keep it. Coverage doesn't replace LeanIX, Ardoq, or your procurement tools. It sits above them — adding a judgment layer they don't provide.

Many teams use Evale alongside existing systems.

- Your EAM tracks what you have — we reason about what to do with it

- Import from existing systems — no duplicate data entry

- Feed discovery back — shadow IT detected flows into your EA process

- No lock-in — export everything, anytime

Already using an EAM or procurement system?

What customers are saying

10.000€ +Cost Savings

Evale is excellent at providing a quick yet insightful market overview, enabling tool decisions 1–2 months faster. The negotiation proposals can save substantial amounts of money — a valuable added benefit.

How to start

Two ways to begin. Both lead to the same system.

After a Decision ReviewMost Common

Explore Decision ReviewAlready have your dataFor Mature Orgs

You already have inventory data — from an EAM, SAM tool, or internal system. We validate it, normalize structures, and connect it to market intelligence.

- Import from existing systems

- Validation and normalization included

- First quarterly review within 4 weeks